Indices

Indices trading

Trade CFDs offer 55+ currency pairs - majors, crosses and exotics.Tight spreads and NO re-quotes

Trade NowOther Trading Markets

It’s time to try us. Enjoy competitive spreads & high leverage.

Advantages of Indices Trading

Benefit with us.

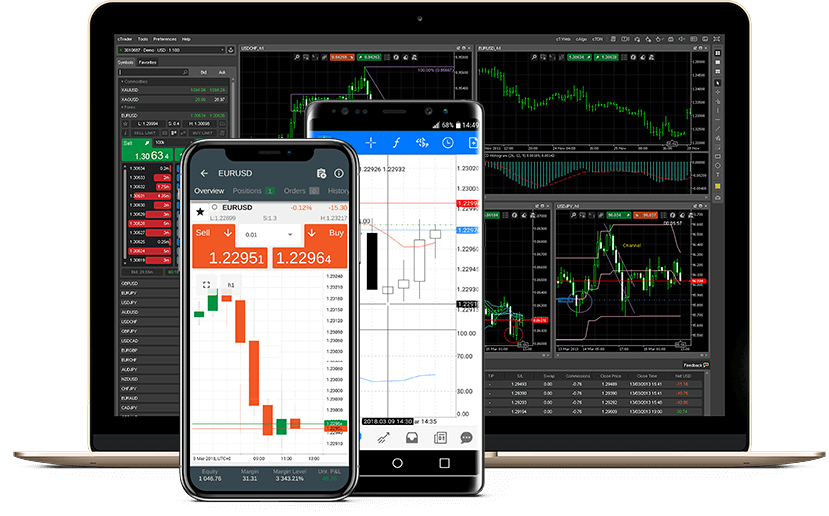

Choose Your Platform

Start trading the instruments of your choice on the Download IOS APP

and Download Andriod APP , or on a variety of mobile devices.

Alternatively, you may also want to try out the Spec Capitals Ltd WebTrader,

instantly accessible from your browse.

Why trade with Spec Capitals Ltd

Benefit with us.

Unmatched Liquidity

Enjoy access to robust liquidity pools that enable seamless execution of your trades, even during volatile market conditions.

Trading Platforms

Choose Forex trading platforms including Spec Capitals Ltd MT5

Globally Renowned

Our management has visited over 500 cities globally to understand clients’ and partners’ needs to boost services.

Experts

Dedicated to providing disabled or elderly assistance to our patients. With over 8+ years

Trade 1000+ Instruments

Fx Trade CFDs on Forex , Futures, Indices, Metals and Energies .

International Awards Winner

Best Award Winning |The Most Trustworthy Broker

Energy

Energetic Services are the leading Sole Proprietorship firm, engaged in Trading and Supplying

Honesty

We are generates trust with your customers,you'll be able to solve any problems they have without any hassle

24/5 Customer Support

Access our 24/5 global customer support.

About Equity Indices Trading

Equity indices, often referred to as stock indices, serve as crucial indicators of specific segments within the stock market. These indices gauge the value of a particular section of a stock market by calculating a weighted average of select stock prices belonging to the corresponding category. These indices can either represent a distinct stock market, like NASDAQ, or encapsulate the largest corporations within a nation, such as the American S&P 500, the British FTSE 100, or the Japanese Nikkei 225.

The primary objective of these indices is to provide insight into the overall trajectory of a specific stock market or a nation's economy at large. However, given that stock indices encompass a variety of companies, their movement can be significantly influenced by notable shifts in a single company or an entire sector.

The weighting assigned to a stock index within the underlying stock basket varies across different indices. Consequently, the criteria for deriving the final result differ among indices. The primary methods for calculating the weight of an individual underlying stock in relation to the index are price weighting and capitalization weighting.

Below are examples of some widely recognized indices and their respective categories:

1. Dow Jones (US30) and Nikkei 225 (Japan225) are examples of price-weighted indices.

2. FTSE 100 (UK 100), ASX200 (Australia 200), Hang Seng Index (Hong Kong 50), DAX (Germany 30), CAC 40 (France 40), and IBEX35 (Spain 35) represent prominent stock indices that employ capitalization weighting methods.